There are numerous fees in our daily lives, including fees for membership, late payments, processing, and transactions. On certain days, it may seem simpler to just accept them. However, online donation processing fees aren’t always necessary or even as high as some service providers charge.

What Are Donation Processing Fees?

A donation processing fee is a minimal amount, a nominal flat cost, or a percentage of your donation amount charged for processing. Online payment processing fees are required to keep donor management and online payment infrastructures operating efficiently and securely.

These fees are most frequently associated with online donations and cover processing fees associated with third-party payment processors or online fundraising platforms. Nonprofits frequently believe they must either accept fees or cease accepting credit cards. Every third-party payment processor, such as PayPal or Stripe, charges them an integration fee for using their services.

Why Do Processing Fees Matter?

In most cases, processing fees take 5% to 6% of your donation for processing purposes, meaning that whoever benefits from the donation is receiving less than what the donor has given. Donors want to know that their monetary contributions are going to those in need, and the vast majority want their contribution to support a specific cause in its entirety.

Many contributors (particularly technologically savvy youth) will research the charitable organization’s practices before ever considering donating and withhold their contribution if they suspect the intended donation isn’t reaching its destination.

Donation Processing Fees: Best Practices

We can’t expect processing services to do their part free of charge, but thankfully we can employ some practices to make the process more transparent and fulfilling for those who made contributions and donations.

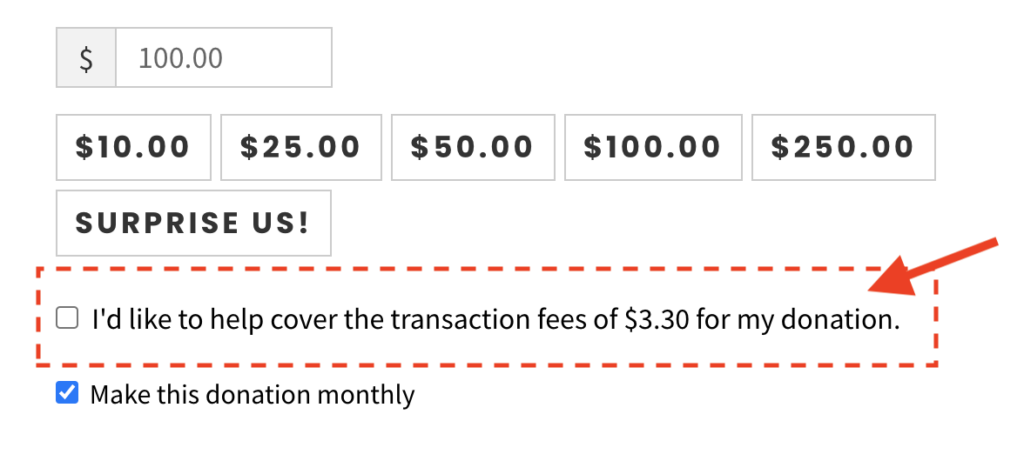

Give Donors a Choice — One of the best practices regarding donation processing fees is to add a checkbox on your donation page that would allow your donors to add an amount to cover administrative costs and processing fees. However, the donor should opt-in to cover the expenses, so your box shouldn’t be pre-checked by default when the page loads. It’s important not to formulate this as a requirement but rather as a “complementary” payment method.

Reasonable Fees — A figure of 3% is what most people consider a reasonable fee, as that percentage is also associated with credit card processing fees. However, be wary of the processing platforms that may charge excessively.

Use Donor-Centered Language — Encourage your donors to cover the processing fees by reminding them how their added gift helps those in need.

Credit Cards — Some credit card providers offer initiatives that place the burden of paying the fees on the donor rather than the charity. Both Discover and American Express provide their cardholders with charitable giving programs that automatically deduce additional 2.25% donation processing fees. Allowing your donors to use these programs would ensure that your organization receives 100% of the donation.

Summary

Unfortunately, scams, fake charities, and overcharging platforms have made many individuals wary of giving to nonprofit organizations and other philanthropic groups.

Schedule a consultation if you want to learn more about donation processing fees. CLICK HERE